Offshore Banking for Dummies

3%, some offshore financial institutions can get upwards of 3-4%, though this might not enough factor alone to financial institution within the jurisdiction, it does tell you that not all financial systems were produced equal. 4. International Financial Institutions Have a Safer Financial System, It is necessary to make certain your assets are kept in a Putting your wide range in a secure, as well as extra notably, tried and true financial system is very essential.

The big commercial banks didn't even come close. International banks are much safer alternative, for one, they require greater resources gets than lots of banks in the US and also UK. While numerous banks in the UK and also United States need roughly only 5% books, many global banks have a much greater resources book proportion such as Belize and Cayman Islands which carry average 20% and also 25% specifically.

The quickest method to avoid this from occurring is to set up a worldwide financial institution account in an abroad jurisdiction account that is outside the reach of the government. Some offshore banks, for instance, do not lead out any type of money and keep 100% of all down payments on hand.

Not known Facts About Offshore Banking

While several domestic accounts restrict your capability in holding various other money denominations, accounts in Hong Kong or Singapore, as an example, allow you to have upwards of a loads money to picked from done in simply one account. 8. Foreign Accounts Provides You Greater Asset Defense, It pays to have well-protected financial resources.

With no accessibility to your assets, exactly how can you defend on your own in court? Cash as well as properties that are kept offshore are much harder to take since international governments do not have any kind of jurisdiction as well as for that reason can not compel financial institutions to do anything. Regional courts and also governments that manage them just have actually limited influence (offshore banking).

, that is not as well surprising. If you are hit with a legal action you can be virtually reduced off from all your properties before being brought to trial.

Offshore Banking for Dummies

Be certain to check your nations agreements as well as if they are a signatory for the Common Coverage System (CRS). Nevertheless, with an overseas LLC, Limited Business or Trust can supply a measure of discretion that can not be found in any type of individual domestic account. Financial institutions do have an interest in keeping personal the names and details of their customers as in position like Panama where privacy is militantly kept, however, Know Your Consumer (KYC) rules, the CRS as well as the OECD have actually significantly improved financial personal privacy.

Utilizing candidate directors can also be utilized to develop an additional layer of safety and security that removes your name from the documentation. This still does not make you completely anonymous it can provide layers of safety and security as well as privacy that would otherwise not be possible. Takeaway, It is never too late to establish a Fallback.

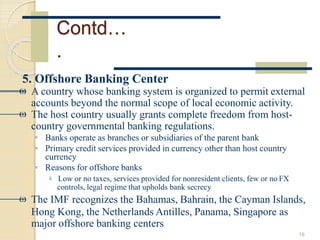

What Is Offshore? The term offshore describes a location beyond one's home nation. The term is commonly made use of in the banking and also economic fields to define areas where policies are different from the home nation. Offshore places are typically island nations, where entities establish firms, financial investments, as well as deposits.

The Facts About Offshore Banking Revealed

Raised pressure is leading to more reporting of international accounts to worldwide tax obligation authorities. In order to certify as offshore, the activity taking area must be based in a country various other than the firm or investor's house country.

Unique Factors to consider Offshoring is flawlessly lawful due to the fact that it gives entities with a fantastic deal of privacy and privacy. There is enhanced pressure on these nations to report international holdings to international tax obligation authorities.

Kinds of Offshoring There are a number of types of offshoring: Organization, investing, and also financial. This is the act of establishing particular business functions, such as production or call facilities, in a country various other than where the business is headquartered.

Getting My Offshore Banking To Work

Firms with considerable sales overseas, such as Apple and also Microsoft, may take the possibility to keep relevant profits in offshore accounts in nations with lower tax problems. This technique is primarily made use of by high-net-worth investors, as running offshore accounts can be especially high.

Offshore financiers may also be scrutinized by regulators and also tax obligation authorities to make certain taxes are paid.

Offshore jurisdictions, such as the Bahamas, Bermuda, Cayman Islands, and the Island of Male, are preferred as well as understood to provide fairly secure financial investment possibilities. Advantages and Drawbacks of Offshore Investing While we have actually provided some normally accepted benefits and drawbacks of going offshore, this area looks at the advantages as well as drawbacks of overseas investing.

Some Known Facts About Offshore Banking.

This means you could be responsible if you don't report your holdings. You should do your due persistance if you're mosting likely to invest abroadthe very same means you would certainly if you're associating with a person in the house. See to it you select a reputable broker or financial investment specialist to guarantee that your cash is handled appropriately.

check my source read more look at here